ASE extends gains as investor confidence improves

The Jordan Times

AMMAN — The Amman Stock Exchange (ASE) extended its gains on Tuesday, with the All-Share Index closing at 3,611 points, up 39 points, continuing a positive trend seen since the beginning of 2026.

The Premier Companies Index rose to 1,978.17 points, while the Total Return Index advanced to 2,601.50 points, reflecting improved overall market performance.

Market analysts attributed the gains to growing investor confidence in the national economy, supported by stable fiscal and monetary conditions, as investors await upcoming corporate earnings and key economic indicators, the Jordan news agency, Petra, reported.

Trading activity showed a marked improvement, with turnover and volumes rising significantly compared with the same period last year. Since the start of 2026, total trading volumes have increased by 41 per cent, the number of contracts by 60 per cent, and shares traded by 34 per cent. The market capitalisation of listed companies rose by JD177 million, or 0.74 per cent, signalling renewed liquidity and investor interest.

Leading stocks drove the rally, notably Jordan Petroleum Refinery Company (Jopetrol), Jordan Phosphate Mines Company, Arab Bank, Afak Energy, and Jordan Telecom, which dominated trading activity.

Arab Jordan Investment Bank, Jopetrol, Sibaq for Investment, Jordan Vegetable Oils Factories, and Tadamun Real Estate Investments recorded the highest price gains during the session.

Analysts said improved liquidity and sustained interest in blue-chip stocks point to a cautious but steady shift towards optimism. They added that fiscal discipline, regulatory reforms by the Jordan Securities Commission, and the stability of the Jordanian dinar under the Central Bank’s monetary policy have enhanced the ASE’s appeal as a reliable investment destination.

Observers expect the positive momentum to continue in the coming months, supported by a balance between fiscal discipline and growth-oriented initiatives, alongside prudent monetary policies aimed at maintaining currency stability and controlling inflation. The ASE’s performance, they noted, continues to mirror broader economic trends, signalling a gradual return of investor confidence.

Latest News

-

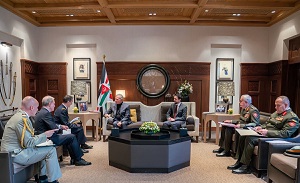

King meets with France chief of defence staff

King meets with France chief of defence staff

-

Jordan will not be a launch point for military action against Iran — Safadi

Jordan will not be a launch point for military action against Iran — Safadi

-

King, UAE president discuss regional developments in phone call

King, UAE president discuss regional developments in phone call

-

Gaza's Rafah crossing makes limited reopening after two-year war

Gaza's Rafah crossing makes limited reopening after two-year war

-

Iran President Orders Start of Talks with US

Iran President Orders Start of Talks with US