Gold Rallies Beyond $4,300/oz, Set for Best Week in 17 Years

Reuters

Gold notched a new high above $4,300 an ounce on Friday and was poised for its best week in over 17 years, as signs of weakness in US regional banks, global trade frictions, and further rate-cut hopes pushed investors to the safe-haven metal.

Spot gold rose 0.9% to $4,362.39 per ounce, as of 0439 GMT, after scaling another record high of $4,378.69 earlier. US gold futures for December delivery jumped 1.7% to $4,375.50, Reuters reported.

Bullion has risen about 8.6% this week and is headed for its best week since September 2008, notching a record high in each session.

Spot silver rose 0.3% to $54.41 per ounce, set for an 8.2% weekly gain. Earlier in the session, prices reached a record high of $54.35, tracking the rally in gold and a short squeeze in the spot market.

"(For gold) $4,500 could arrive as a sooner-than-expected target, but much may depend upon how long concerns about US-China trade and the government shutdown linger over the market for," said KCM Trade Chief Market Analyst Tim Waterer.

China levelled fresh accusations against the US of causing panic over its rare earth controls, while rejecting calls to reverse export curbs.

Meanwhile, US Federal Reserve Governor Christopher Waller voiced support for another rate cut due to labor market concerns.

Investors are expecting a 25-basis-point reduction at the Fed's October 29-30 meeting and another reduction in December.

Elsewhere, Wall Street closed lower on Thursday, with signs of weakness in regional banks spooking investors already on edge over US-China trade tensions.

"The flare-up in US regional bank credit concerns has given traders one more reason to buy gold," Waterer said.

Non-yielding bullion, which tends to do well in a low interest rate environment, has gained more than 66% year-to-date, driven by geopolitical tensions, aggressive rate-cut bets, central bank buying, de-dollarization and robust exchange-traded-fund inflows,

On the geopolitical front, US President Donald Trump and Russian President Vladimir Putin agreed on Thursday to another summit on the war in Ukraine.

Western nations continued to pressure Russia over its oil sales, with Britain imposing sanctions on major Russian oil firms.

Platinum fell 0.4% to $1,706.45 and palladium rose 0.3% to $1,618.95. Both metals were headed for weekly gains.

Latest News

-

Syrian leader seeks reset in Russia relations in Putin meeting

Syrian leader seeks reset in Russia relations in Putin meeting

-

Israel expected to open key aid crossing into Gaza

Israel expected to open key aid crossing into Gaza

-

US military chief urges Hamas to stop executions of Palestinian civilians in Gaza

US military chief urges Hamas to stop executions of Palestinian civilians in Gaza

-

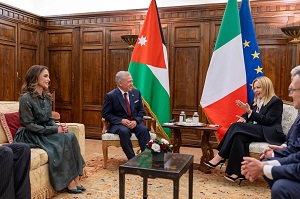

King, Italy PM call for ensuring implementation of Gaza agreement

King, Italy PM call for ensuring implementation of Gaza agreement

-

King, Queen meet with Pope Leo XIV

King, Queen meet with Pope Leo XIV