Gov’t completes eurobond repayment under debt management strategy – ministry

The Jordan Times

AMMAN — The Ministry of Finance has completed the repayment of eurobonds maturing at the end of January 2026, following an early partial redemption aimed at lowering borrowing costs and easing debt servicing pressures in the short and medium term, the ministry announced on Thursday.

It also said that it had fully redeemed the eurobonds due in January 2026, which were originally issued on November 2015, at a value of $1 billion with an interest rate of 6.125 per cent.

According to the ministry, $612 million, along with accrued interest, was repaid in January, while a further $ 388 million was settled ahead of schedule in November last year, marking the first early redemption of eurobonds in decades, with the aim of reducing interest costs.

The repayments were financed through the issuance of new eurobonds worth$700 million in November 2025, carrying a competitive interest rate of 5.75 per cent and a seven-year maturity, representing the lowest spread achieved on international bond issuances in decades.

Additional financing was secured through a package of concessional loans and the issuance of Islamic sukuk at average interest rates ranging between 5 and 5.5 per cent, obtained by the government over the past year. Part of the proceeds from the eurobond issuance and concessional loans was deposited with the Central Bank of Jordan to be used for settling eurobonds maturing this year.

The ministry said the measures form part of the government’s public debt management strategy, which focuses on replacing higher-cost borrowing with more favourable financing. The strategy aims to reduce debt servicing costs, lower medium-term funding needs, and strengthen debt sustainability, while supporting the placement of public debt on a declining path relative to gross domestic product.

Latest News

-

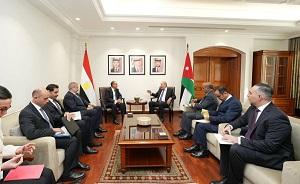

Safadi, Egyptian counterpart hold talks on Gaza, regional developments

Safadi, Egyptian counterpart hold talks on Gaza, regional developments

-

King, Crown Prince visit JAF General Command

King, Crown Prince visit JAF General Command

-

US Reports Constructive Talks with Israel's Netanyahu on Gaza Plan

US Reports Constructive Talks with Israel's Netanyahu on Gaza Plan

-

Iraqi Lawmakers to Elect President Tuesday, PM Appointment Next

Iraqi Lawmakers to Elect President Tuesday, PM Appointment Next

-

US Storm Leaves 400,000 without Power, Forces Thousands of Flight Cancellations

US Storm Leaves 400,000 without Power, Forces Thousands of Flight Cancellations