CBJ maintains interest rates on monetary policy instruments

The Jordan Times

AMMAN — The Open Market Operations Committee of the Central Bank of Jordan (CBJ) on Thursday decided at its first meeting of 2026 to keep the main policy rate, along with all interest rates on monetary policy instruments, unchanged.

The CBJ said the decision reflects continued monetary stability in the Kingdom and aims to ensure alignment between domestic interest rates and those in regional and international financial markets, the Jordan News Agency, Petra, reported.

Foreign reserves at the Central Bank exceeded $ 26 billion by the end of January 2026, providing coverage for nine months of imports of goods and services.

The dollarisation rate of deposits declined to 18 per cent by the end of November 2025, indicating strong monetary and banking stability and sustained confidence in the Jordanian dinar.

Inflation averaged 1.77 per cent in 2025, a level the bank described as appropriate for supporting economic competitiveness and preserving purchasing power.

The banking sector continued to record solid performance, with total deposits increasing by 7.2 per cent year on year to JD 49.8 billion by the end of November 2025. Outstanding credit facilities rose by 3.3 per cent to JD 36.2 billion.

Banks maintained high levels of liquidity, capital adequacy and returns, reflecting the resilience of the sector, prudent risk management and the capacity to continue supporting economic activity at moderate interest rates.

Latest economic data showed positive performance across external sector indicators, in line with CBJ projections. Tourism receipts increased by 7.6 per cent in 2025 to $ 7.8 billion, while remittances from Jordanians working abroad rose by 4.6 per cent during the first eleven months of the year to $ 4.1 billion.

Total exports grew by 7.7 per cent during the first ten months of 2025 to $ 12.1 billion.

Net inflows of foreign direct investment increased by 27.7 per cent during the first three quarters of the year, compared with the same period in 2024, to reach $1.5 billion, the CBJ added.

Economic activity continued to improve gradually across most sectors in 2025, pushing economic growth to 2.75 per cent during the first three quarters of the year, up from 2.56 per cent a year earlier. Growth for 2025 as a whole is expected to be no less than 2.7 per cent.

The CBJ said it will continue to monitor economic, financial and monetary developments at the domestic, regional and international levels, and will take appropriate measures based on economic indicators and global interest rate trends to maintain the attractiveness of dinar-denominated assets and reinforce monetary and financial stability.

Latest News

-

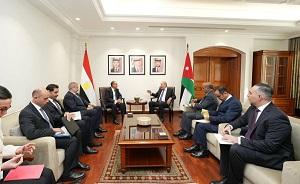

Safadi, Egyptian counterpart hold talks on Gaza, regional developments

Safadi, Egyptian counterpart hold talks on Gaza, regional developments

-

King, Crown Prince visit JAF General Command

King, Crown Prince visit JAF General Command

-

US Reports Constructive Talks with Israel's Netanyahu on Gaza Plan

US Reports Constructive Talks with Israel's Netanyahu on Gaza Plan

-

Iraqi Lawmakers to Elect President Tuesday, PM Appointment Next

Iraqi Lawmakers to Elect President Tuesday, PM Appointment Next

-

US Storm Leaves 400,000 without Power, Forces Thousands of Flight Cancellations

US Storm Leaves 400,000 without Power, Forces Thousands of Flight Cancellations